In Q1, 2017, Sulzer achieved an order intake of Sfr757.6m compared with Sfr684.6m in the same period of the previous year.

Adjusted for currency effects, the growth rate was 11.1%, while orders grew by 2% when adjusted for currency and acquisition effects. Order intake increased in all divisions with the exception of Chemtech.

Order intake

In Q1, 2017, order intake increased by 11.1% on a currency-adjusted basis compared with the same period in 2016. Currency impact was a negative 0.4%. Acquisitions contributed Sfr62.4m or 8.2% to Sulzer’s order intake. Organically (excluding currency effects and the impact of acquisitions), order intake increased by 2%. Organic order intake in Q1 turned out stronger than expected driven by a higher number of larger orders in pumps equipment than in the same period a year ago. Despite a comparably high base in the previous year’s quarter, Chemtech achieved an organic order intake at almost the same level this quarter.

Order intake from the oil and gas industry was up 12% in Q1, 2017, compared with the Q1, 2016, and it was flat sequentially. Sulzer’s downstream segment continued to rebound in new equipment and aftermarket services. The upstream segment still suffered from challenging market conditions mainly in the new equipment business, while aftermarket services improved.

Orders in the water segment increased significantly. Orders in the power segment declined driven by lower aftermarket business. Including acquisitions, order intake from general industries grew strongly.

Regionally, order intake increased across all regions. Growth was particularly strong in China across all divisions. Supported by acquisitions, Europe increased significantly.

On 1 January 2017, Sulzer changed two aspects of its reporting structure for increased transparency and customer focus. First, the combination of the Sulzer Mixpac Systems (SMS) business unit and the recently acquired Geka and PC Cox businesses are now being reported as the new Applicator Systems division. Secondly, the pumps spare parts business was shifted from Pumps Equipment to Rotating Equipment Services. This move allows customers to benefit from a single access point for services and parts.

Two acquisitions closed

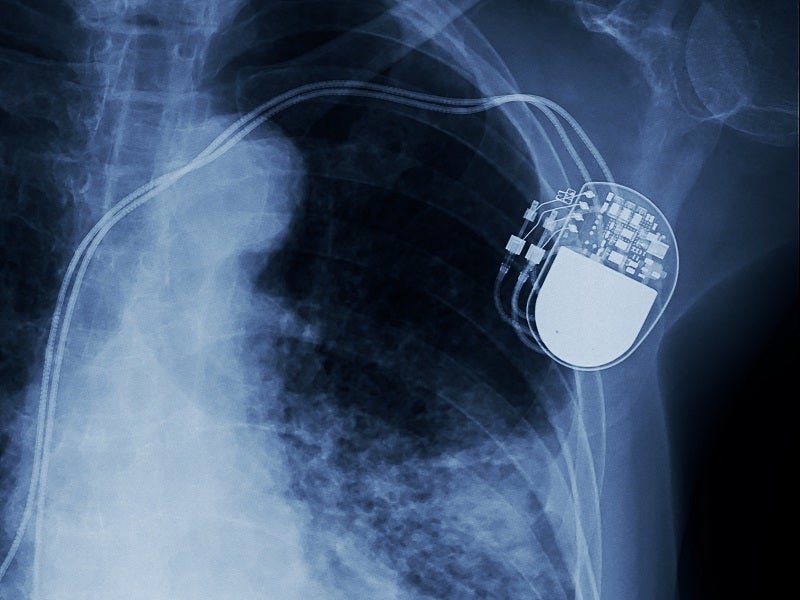

In Q1, 2017, Sulzer closed acquisitions of Ensival Moret and the Vessel Internal Electrostatic Coalescer (VIEC) product line.

The acquisition of Ensival Moret allows Sulzer to close specific product gaps in axial flow and slurry pumps. Ensival Moret offers a wide range of industrial pumps with strong positions in a diverse range of industries including fertilisers, sugar, mining, and chemicals. Combining the complementary product portfolios enables Sulzer to become a full line supplier in a broad range of industrial process applications.

The acquisition of VIEC allows Sulzer to further extend its Chemtech upstream product portfolio for advanced oil and water separation applications. It is a complementary technology to Chemtech’s current products.

In Q2, Sulzer expects to close its acquisition of a controlling stake in Rotec’s gas turbine maintenance business (Rotec GT). Rotec GT, headquartered in Moscow, is mainly active in the Russian market.

Outlook 2017 confirmed

Sulzer confirms its guidance for the full year. Order intake is expected to increase by 5% to 8% and sales by 3% to 5%, both currency-adjusted and including the acquisitions announced in 2016. Supported by the cost savings from the SFP programme, the company expects an operational earnings before interest, taxes, and amortisation (EBITA) margin of around 8.5% (operational EBITA in percent of sales).

Conference call

Sulzer will hold a short conference call on the occasion of the publication of Q1 order intake results 2017. Chief executive officer (CEO) Greg Poux-Guillaume and chief financial officer (CFO) Thomas Dittrich will review Q1 2017 order intake and answer your questions.